In last article we analyzed the behavior of the virtual investments during the main bear markets happened in period 1971-2020.

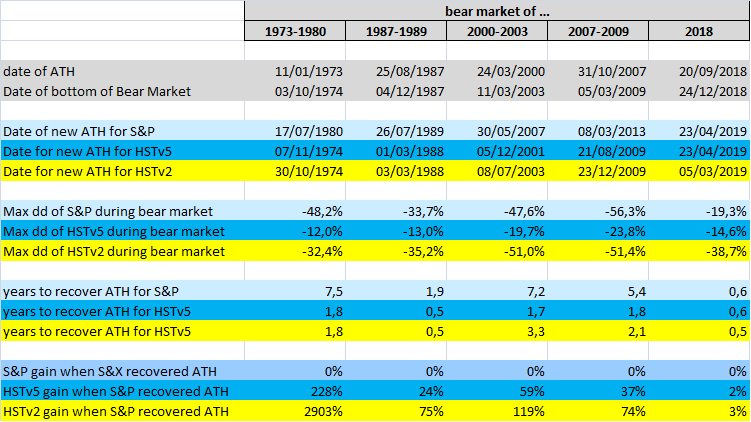

We could see how a "Buy&Hold" strategy applied to the S&P index has lead to massive drawdowns, and slow recoveries.

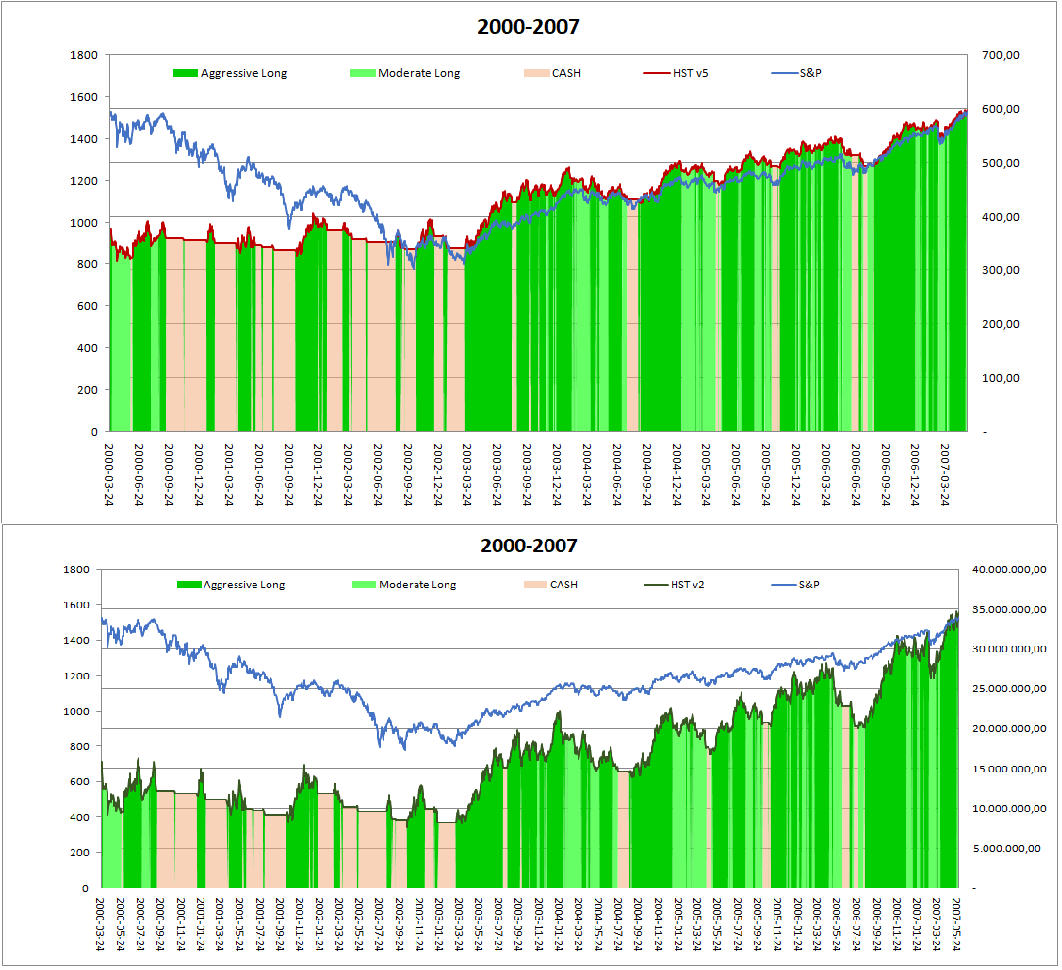

For example, after topping in March 2000, the S&P has lost 47.6% of its value in 2003, and slowly returned to the orignial value in 2007.

But then another bear phase hit the S&P and it crashed for a -56.3% from top of 2007, and did not recover the previous to until march 2013.

During these 13 years of blood and pain, I doubt that any investor have been really holding the investment and wait. A big loss has much more likely happened.

Compared with the B&H strategy, the HST model variant 5 (with no leverage) has shown much better performance. It

- has reduced significantly the suffered drawdowns

- has reduced significantly the time before recovering the previous tops

- has given a much better yield on average

Now we want to show the behavior of HST model variant 2, using 3x leveraged ETFs as $TQQQ and $UPRO.

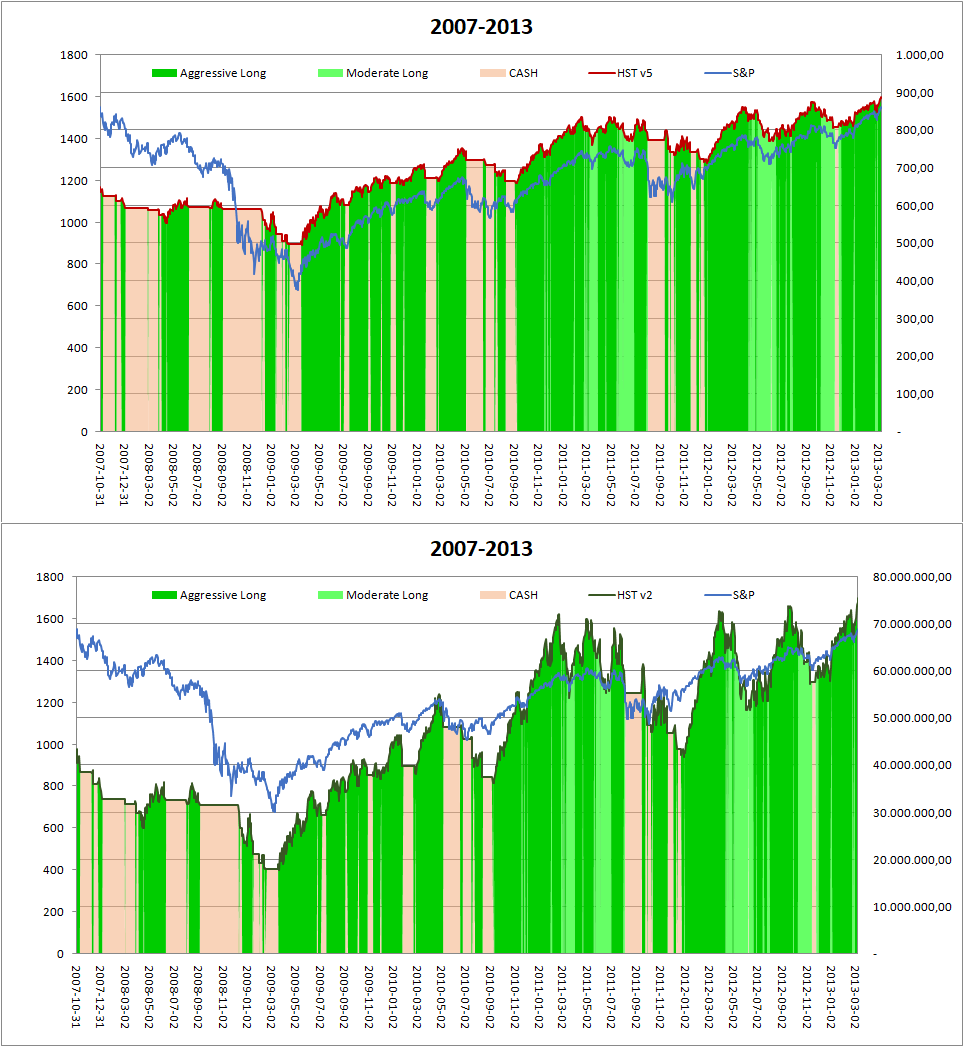

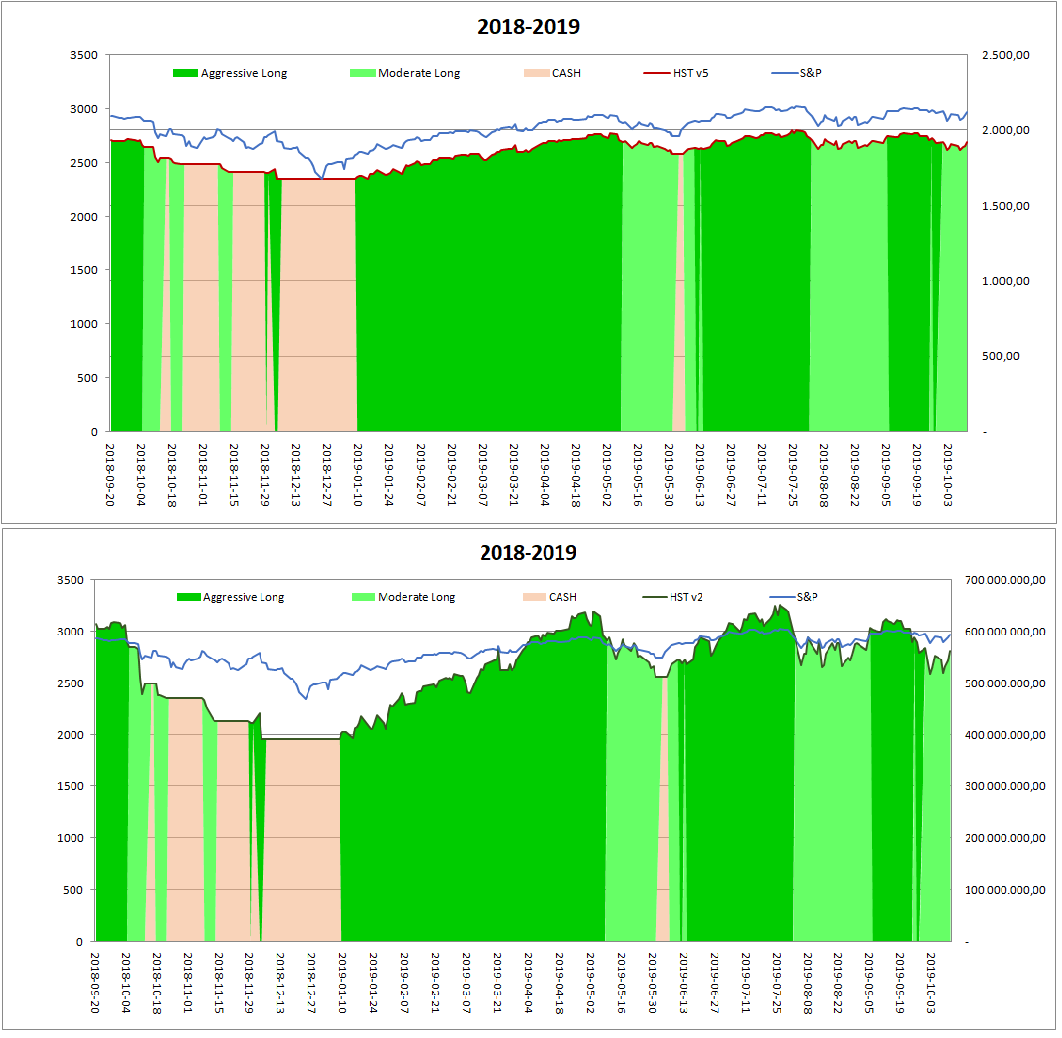

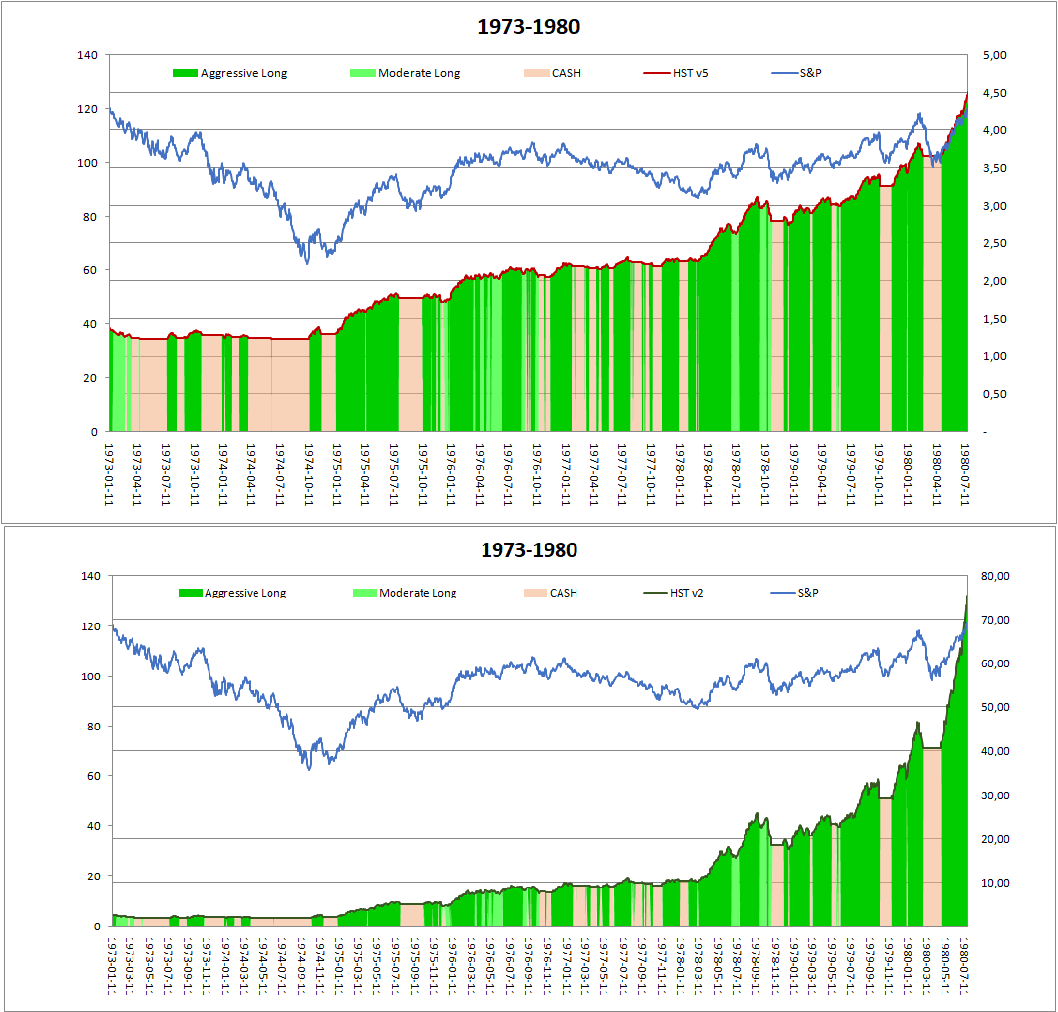

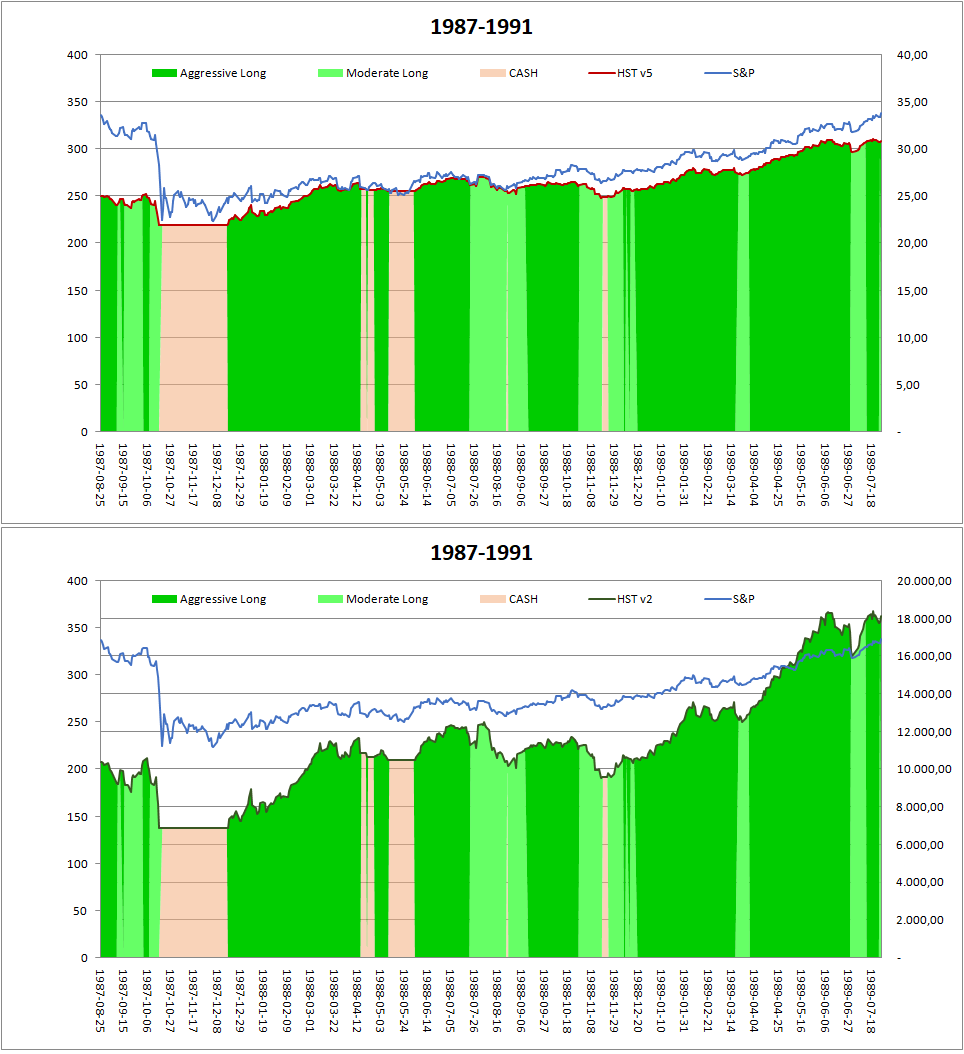

Here are detailed pictures of the the same bear periods:

- In the upper graph of each picture the red line is the HSTv5 (no leverage)

- In the lower graph of each picture the green line is the HSTv2 (3x leverage)

The responses are similar in shape for variant 2 and variant 5, but different in magnitude: the HSTv2 (3x leverage), compared with the HSTv5 (no leverage) showed

- bigger drawdowns

- usually longer times to recover new tops after crashes (because of the greater magnitude of the drawdowns)

- much better final yields at the end of the recovery period

Bottom Line

Now we can answer to our original questions:

“if a bear market like on of the past ones is starting tomorrow, am I ready to face it ?"

"Am I ready to accept this magnitude of drawdowns without panicking ?”

Every investor should have made up its own opinion, but we can agree about these points:

- Buying and hold the S&P is not an acceptable strategy, because it could crash and give us huge drawdowns (-47% -56%).

It tipically takes 2 / 7 years before recovering back the previous tops.

Average annual yield has been +7.4% in the last 49 years - If we can accept a drawdown on our invested capital of -15% / -24%, the HST model variant 5 (no leverage) is the right approach.

In worst cases it recovered back the previous tops after 2 years or less.

Average annual yield has been +17.0% in the last 49 years - If we can accept a drawdown on our invested capital of -35% / -55%, the HST model variant 2 (3x leverage)* is the right approach.

In worst cases it recovered back the previous tops after 3/4 years or less.

Average annual yield has been +52.1% in the last 49 years

* this a very risky strategy anyway, for which we suggest to dedicate a minor part of the invested money

How can I receive clean, effective signals like this below, from HST?

Subscribe to our educational service and get daily signals, writing to This email address is being protected from spambots. You need JavaScript enabled to view it..

Important note: past performance is not indicative of future results.