Economy down, markets up.

We had an amazing rebound of the stock markets, since the bottom of March 23rd.

Since then S&P500 has made a +31%, Nadsdaq Comp +30%, returning back to levels of early 2020.

Should we consider this bear market over already?

- By a technical point of view, momentum is very good, and there is no reason to be afraid

- By a fundamental point of view, this price level looks absolutely insane and irrational

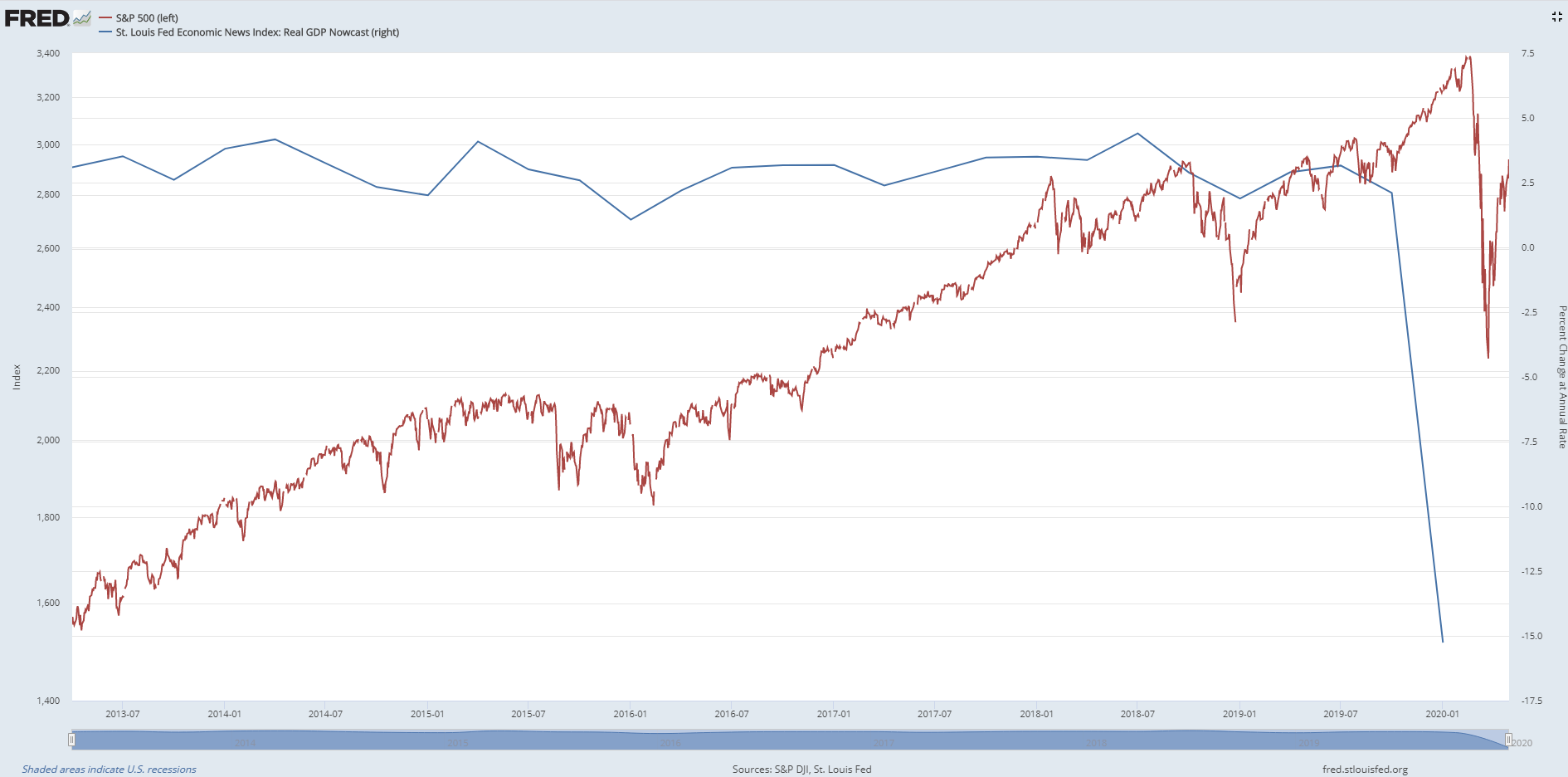

All the indicators of the economy are crashing in the US, and in most important areas of the world.

The end of the lockdown is going to be slow and critically exposed to possible second/third waves of the infection.

Economic data are already terrible (see article), and nobody is seeing a “V-shaped” recovery in the next months for the business (not talking about stock prices here).

It will more likely take many months or some years to get back to “normality”.

What matters more, in terms of the perspective of the financial markets, is the drop of the employment rate. The US economy is based on consumer spending, and a rising unemployment means

- less expenditures (which means – again – less jobs)

- problems on payments of mortgages, rentals, other debts (which could bring to credit issues for banks)

- minor or negative profits/earnings for companies

All the above data are happening already, and usually they have a hard impact on the stocks’ prices.

So, are the actual levels of indexes showing this? Not even close.

In January 2020 stocks were showing high evaluation and P/E ratios. Now that “E” = earnings are going to drop for a significant period of time, could we evaluate companies as much as before? Not at all.

Are investors willing to buy stock so much priced, when the forecasted earnings are dropping? Would you pay the same price for an asset which is reducing dramatically revenues and dividends for next years? I don’t think so.

...Should we argue that the market has gone crazy and investors out of their mind?

History tells us that market can be “irrational” for long time. So we won't act presuming we are right and the market is wrong.

What are the reasons of this amazing recovery of last weeks?

- FED will push lots of money in the circuit, this is the main reason. One can object that money ≠ real health, and the public federal debt is going to rise a lot. Somebody will have to pay for this.

- FED has assured to keep low/zero rates until the economy and employment of the country are out of the woods. Believe me, I agree it is the right thing to do.

- But this also implies that FED will have no additional weapons in case thing get even worse.

As traders and investors we all have learned that you do not have to fight the market. As crazy it might sound, market is always right, and traders should not fight against it. Never.

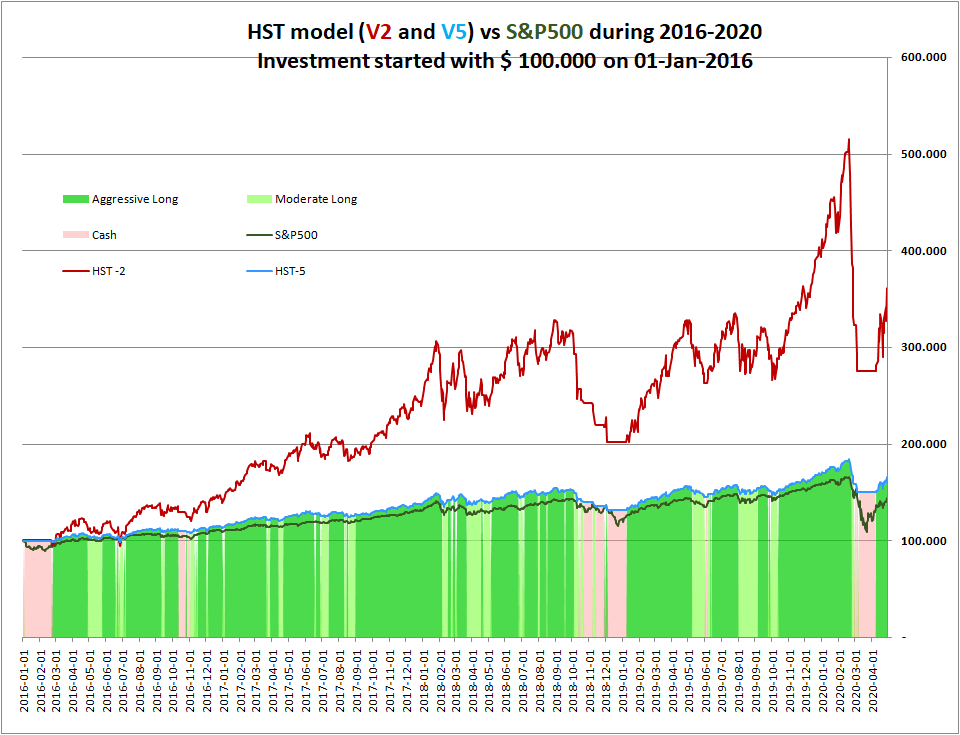

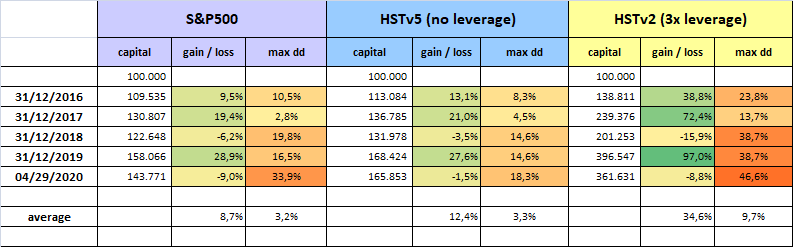

That is the reason why the HST model works fine, works better than our gut feelings: it is designed to take advantage of the “internal” rallies which often happen during a bear market [the macro economic data say WE ARE in a bear market, no doubt about that!].

And you know that - despite the fundamentals are bad - the HST model is actually positioned "Aggressive Long".

Bottom line

We do not expect that market will surge during next months, we are more convinced it will drop and touch lower lows.

So the actual recovery performed by stocks and by virtual investments based on HST model, could be lost again during a possible next drop, before we are pushed back to a CASH position.

This is what frequently happens during the bear markets, we will see poor/red yields, as anyone who are not sitting 100% cash already.

On the other hand

- If the market continues rising and the current rebound will turn into a new "Bull Market" (against our feelings based on the perspectives of the economy), the HST model will stay Aggressive Long, and give amazing profits even during 2020

- If the market drops again and stays low for a long time, as normal bear markets do (which is our current view), the HST model will soon push us to cash, ready to re-enter when the right time will be

In other words the technical component of the HST model now is telling that momentum is good, but the fundamental component says that economy is getting worse, and we must be careful in mid-long term.

At any time we can apply the HST model also setting the size of our positions. For cautious investors this might be the right time to reduce their positions, especially if they operate with the leveraged variant.

-----------------------------------

Write to This email address is being protected from spambots. You need JavaScript enabled to view it. and get more information about daily signals from the HST model released to members.