Market reacts, but clouds are still there

Until mid February 2020 investing in the stock market was considered dangerous, as the valuations were so high that one could hardly believe they could grow more.

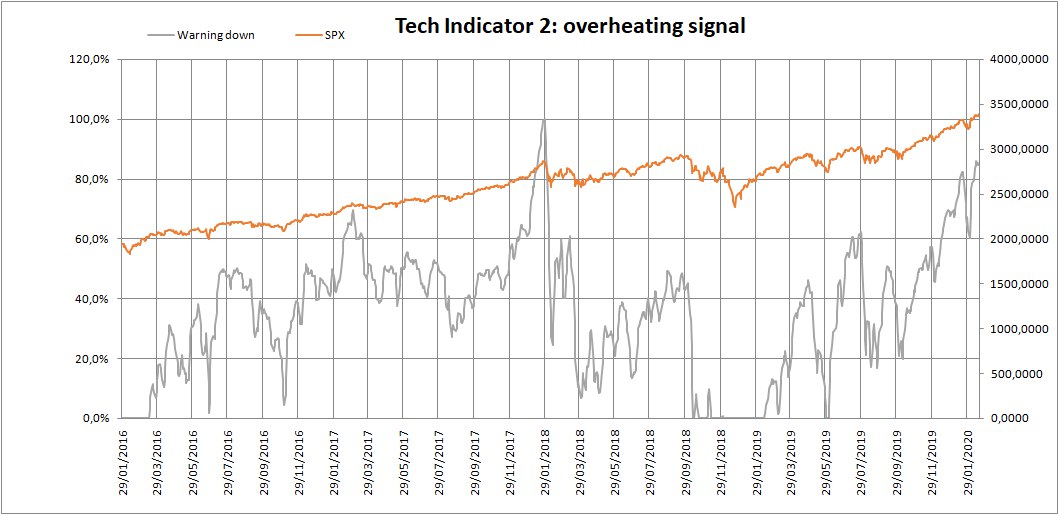

This is an alert signals offered to the memebers of the HST Educational Service on February 19th, with the warning of "overheated" condition of prices.

But one could think the same also in 2016, 2017 and 2019.

Valutations (let’s pick the P/E ratio as an indicator) can be high, and go higher and higher for a long time. If there is much money flowing into the stock market, and people keep investing (buying pressure is higher than selling pressure), stocks will rise, beyond any other consideration.

Beside valuations, there wer other negative factors in mid-Feb-2020: the economy was in good shape, but could hardly improve more, and a period of decline - maybe a mild decline - was expected to come for economy and for stocks.

Then the unpredictable happened, trimming this long tail of the 2009-2020 bull market. Prices dropped sharply for a -30% or more.

According to many experts, a -20% or -30% drop is the definition of “bear market”, and we’ve got there in 3 weeks only.

- So the feared “bear market” has been finally prepared, packed and delivered

- Last week (March 23-27) the market has reacted with a +15%

- Valuations are now much lower, and many of the fears we could have had in mid-Feb vanished along with the high valuations: an investor could buy/accumulate stocks, which will eventually rise, someone say before the end of 2020.

- Is that a reasonable picture? Is this bear market already over?

I don’t think so.

Valuations are only a part of the game, and not the most important. Yes, if we look at the P/E ratio, Prices “P” are now lower, but what about the denominator “E” = Earnings?

In the long term it is the economy driving markets, and the economy is only at the start of an undefined period of recession.

We don’t know how deep and how long it will be, because the factor triggering it (contagion) is not an economic or political one. It was a contagion that mankind will face, fight, contain, but there is no certainity about times and means.

More specifically, we don’t know how/when factories and small companies could be back 100% operational, we dont’ know how/when consumers in the world will return to their usual behaviors and spedings.

We don’t know either IF things will be the same again: also in the case we defeat the contagion very soon, some habits of people will stay changed for long.

And there is a chance that new spots of contagion appear in places where a first wave has already hit.

Some sectors of the economy will close or shrink for good, some others will survive and return to normality, others will grow a lot, new sectors will show-up.

As for every crisis, there will be also big opportunities.

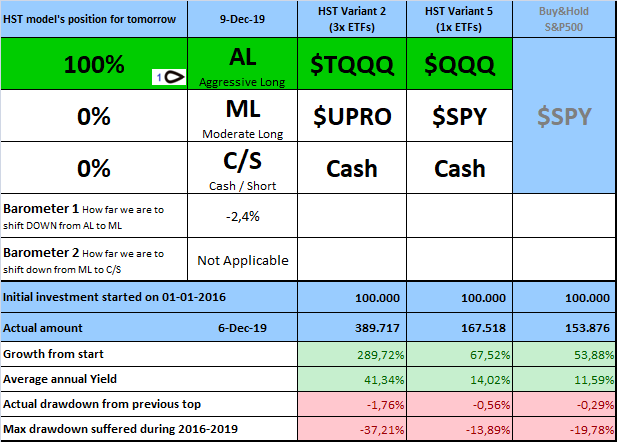

One of the opportunities for long term investors is that stock prices are actually quite reasonable. Investments based on HST model (variants 2 and 5) have suffered noticeable losses during the drop, but the model has shifted to CASH on March 6th (see picture), saving invested money during the harder part of the drop.

But let me say that in this specific drop, the HST model has performed worse than usual (previous drops in history), because of the unprecedented speed of this fall.

HST model was tested on 49 years 1971-2019 and during those 49 year, we’ve never seen such a fast crash. Even last week of partial recovery was not usual, showing high intraday spikes, and an irregular trend. It is time to stay out, until markets find a new equilibrium or a stable trend.

There will be a real equilibrium only when we will know

how to defeat or manage the monster, how much time it will take to apply our counterattack and restore normal life.

Psychology of the masses (and of investors) will be very important during next months. Last week's 10-15% recovery of indexes, is not the start of the new bull market, but the (weak) rebound to a massive previuos drop.

Next bull market: better buy the broad index or pick specific stocks?

The future bull market will be selective (as said before, some sectors will never fully recover, new ones will arise). So, shall we better choose specific stocks to buy?

In our mind, this are good reasons to invest on the broad market (indexes) instead of specific companies or sectors.

We could guess that home services as offered by Amazon, Netflix will not suffer much, and the stocks will likely overperform the market. But this pressure coming from a changed lifestyle will also require new ideas to respond to these new needs; that means calling the rise of competitors with innovative formulas and services.

- So, we prefer to take the whole pack.

Another big question is: will the “US corporate” (and consequently, its financial indexes) prevail on competitor countries during next bull market?

- I am pretty sure it will, because these new challenges are not about manufacturing / reducing prices for larger volumes (where China could be stronger), but about having new ideas, innovations, performing fast developments of products and services, a field where the US system is still at the top.

About future behavior of the HST model

Back to our HST model’s behavior, here are some tips:

- since the Fundamental indicator (see picture) will soon shift to negative, the HST model will only shift between Cash and Aggressive Long, while Moderate Long should be out of table for a while

- the model will try to catch and benefit from temporary rallies during the period of the bear market

- hence we shall shift among positions more frequently than what we have made in 2016-2019

- barometers will be much more useful, pre-alerting investors of possible shifts on daily basis

Final point: why don't we SHORT the market during this bearish condition?

- Because it is very risky

We’ve backtested other variants of the HST model which go SHORT instead of CASH, but there is no significant improvement of gains (just 1% or 2% on annual yields) and there is a greater magnitude of drawdowns. It is not worthy, especially in this crisis.

It is reasonable that the recession will not last for just few weeks, it will affect the worldwide economy for months or years. But again, it is not a recession caused by economic or financial issues, so what if there is a breakout by science?

- A vaccine available in a short time for the whole humanity?

- A rapid and cheap test to identify positives to be quarantined and release the others?

- A management of the contagion, more efficient than the actual social-distance which requires many companies to shut down?

If something like that comes out (or there are just rumors about), markets could soar, dragging our short positions to huge losses. We would suffer another big loss, after the first one.

No, thank you.

-----------------------------------

Write to This email address is being protected from spambots. You need JavaScript enabled to view it. and get more information about daily signals from the HST model released to members.

Here's an example of daily signal, released on December 2019.