[Premise: it is a very hard time for many people in the world, who are suffering casualties for the contagion. In this article we discuss the consequences of the contagion only by financial point of view, not the human one, hoping not to look inappropriate to anybody]

It has been another crushing week on financial markets. These were my words about the situation of the economy on Feb-29, when the Covid19 crisis was at its beginning:

“ .... if we only consider the status of the US economy (which is represented by the Fundamental Indicator in the HST model), I would say that a “V” shaped recovery is the most likely scenario.

........ BUT the CoVid19 contagion could change these premises, affecting the fundamental conditions of the US economy. So, we must be careful: the contagion has not been considered yet in the fundamentals of US economy, and – if things go wrong – we could see a rapid deterioration of the macro data of the US soon enough.

That’s why - given the actual conditions (the actual macro data + the risks due to virus) - I would draw three different scenarios:

- The CoVi1d9 contagion will be contained soon, and the worldwide panic of last week will turn into a huge opportunity to go back in the market for a “V” shaped recovery.

In this case, our HST model will not re-enter into Long positions immediately, and I am ok with this (see next paragraph) - The CoVid19 will spread in some more countries, but consequences will be similar to a very hard flue, with more casualties than past years. Panic lasting for months will affect the economies of the world, but with proper contermeasures, governments will limit damages and no recession will start.

The markets’ recovery will be slower and longer. - The contagion will spread quickly worldwide and, eventhough umanity will surely win this battle, the panic will cause stops of production and deep changes in people’s habits; this will likely lead to a recession and a bear market for stocks. No one can now predict how long it will last. “

After three hard weeks, we can state that we are going to scenario 3, the worst one.

Indexes have burned up all the gains of 2020 and 2019, with DJIA and S&P500 now positioned below the lows of late December 2018 (Nasdaq is still a bit higher).

What about the HST model behavior?

The HST model has shifted to cash on the evening of March the 6th, cutting the losses when S&P was -12.2% from previous top, and saving an additional -20% lost by the index, from 6th to 20th of March.

The bleeding was stopped and we were in a safer place for more than half drop.

[The ones who followed my personal position (reducing positions since feb-21th) have been even luckier, avoiding the whole crash]

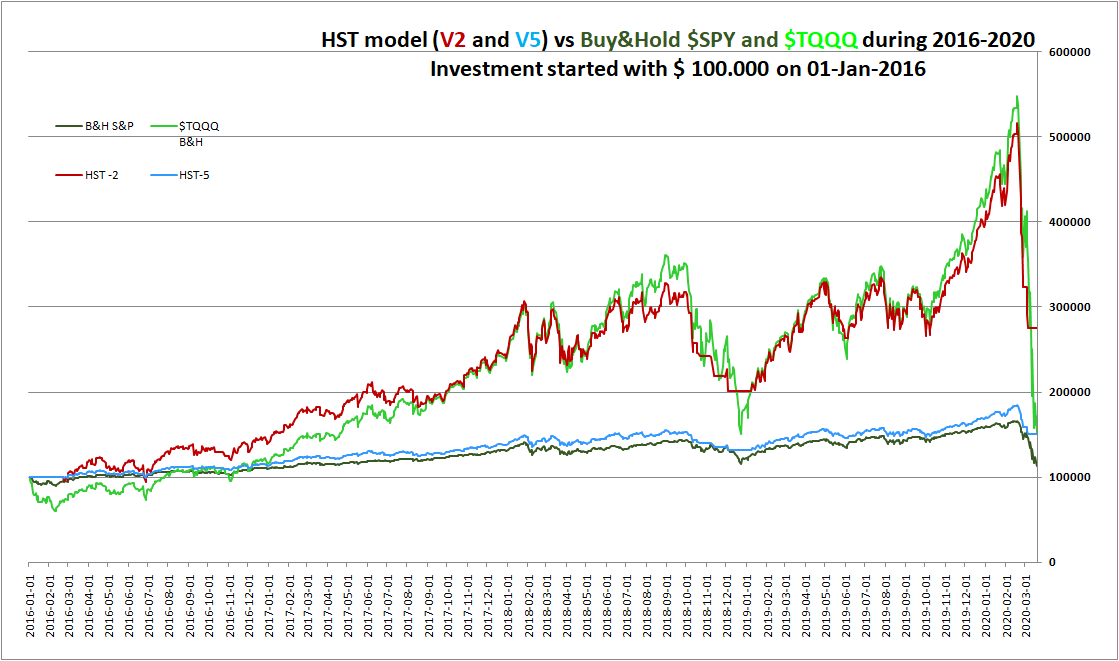

Here is a comparison table among investments

- made with HST-v2 using 3x leveraged ETFs

- made with HST-v5 using not leveraged ETFs

- “Buy and Hold” strategy using Nasdaq 3x leveraged ETFs like $TQQQ

- “Buy and Hold” strategy using S&P not leveraged ETFs

Given the fact that this financial drop is quite unique, we see that the HST model made its job:

during last years, riding the bull and taking advantage of the growth of markets,

during last weeks, suffering losses, but saving most of the investment value.

---------------

Now every investor is wondering if the crash is done, and if we are going to recover from here or not. There is a huge talk about resistances, hystorical precedents, comparisons with previous crashes, and many other topics.

Sincerely I think that there is nothing in history to be looked for: the actual situation is literally unprecedented, and technical signals like “oversold”, “resistance level”, “extreme levels” are quite useless at this very time. Let's simply realize and accept that markets CAN drop more.

The only meaningful questions is: “Will this recession be worse than expected and than what markets are pricing today?”

None has a certain answer. We simply don’t know, and the answer will depend mostly on science and research achievements.

My opinion here is that the fundamentals data coming will tell a definitive word about the end of the 2009-2019 bull market: macro data for US economy were pretty good few weeks ago, but they also were in a position like “cant’ get any better”, which is a typical topping condition for the bull markets.

Now we can be pretty sure that:

Labor market will drop quickly. See latest data released about unemployment (Initial Claims):

Yield curve is already steepening and pointing up (which is a bearish sign):

Credit conditions could be still stable, because of the massive Quantitative Easings promised by central banks, but consequently

Inflation (which is the place where we shall all pay the printed-money to fight this crisis) will rise very soon: less available goods + more money circulating = more inflation, no doubt

Housing market will likely stops its growth, after recent changes in people’s priorities.

What about the HST model?

We think that – within the next 2/3 weeks – bad macro data will be released, and the Fundamental Indicator of the HST model will turn to negative, probably staying down there for several months.

Does it mean that memebers of the Edu Service will be suggested to stay cash for such a long time? Not necessarily.

We shall be shifting just between “Cash” and “Aggressive Long” positions, trying to catch the rebounds of markets, wherever temporary they will be.

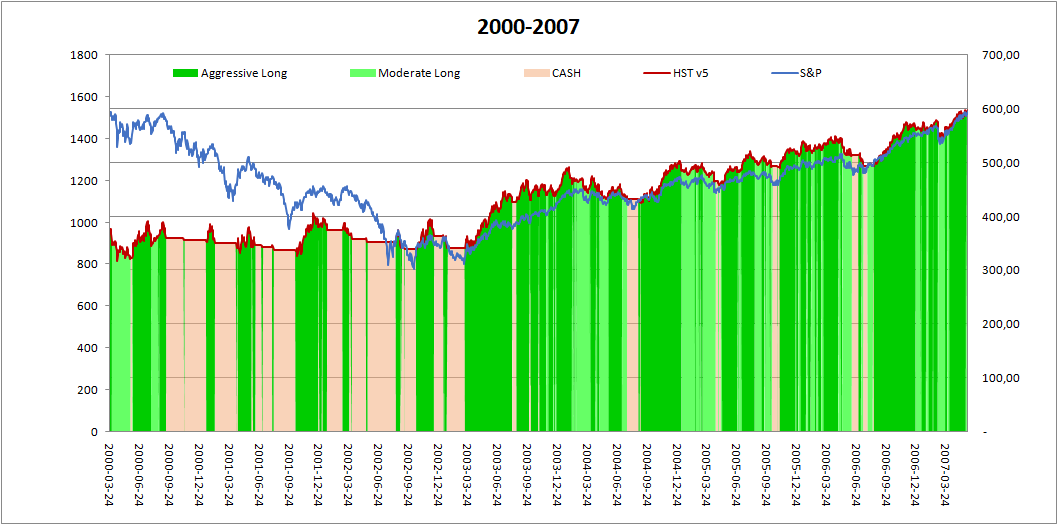

As we have explained in many articles, the HST model gives its best during tough periods, guiding long-term investors about the correct timings to re-enter and investing again.

Tough times are the moments where HST investors could really find big opportunities.

During period 2000-2007, when market crashed with similar speed for Dot-com bubble, and then returned to original levels after 7 years (0% gain) the HST model shifted its position for 44 times / year, gaining something like

+ 56% with variant 5 (no leverage) and + 107% with variant 2 (3x leveraged)

Remember also that our model does not push to invest on specific sectors (which might or might not be envolved in this hoped recovery), but in the broad market, which is a warranty it won’t miss the bull’s ride.

Final point, a grain of optimism

There is lot of political and economic pressure on scientists, medicine companies, entrepreneurs, geniuses of any kind to find a cure / a vaccine / a low-cost test for Covid-19.

In case one, just one of these researchers achieves a significant and game-changing result, the world could rapidly wipe out all this nightmare and re-install a period of growth and hope, and a consequent recovery of markets.

And I refuse to think that we can’t or won’t do it.

My personal guess (it is a guess, I admit) is that during 2020 there will be such a breakout from science.

Write to This email address is being protected from spambots. You need JavaScript enabled to view it. for more information about singals from the HST model.