Let's take a look at the general situation of the US economy by mid February 2020.

You know, in the long-term (and we are long term investor) it is the economy that drives the markets.

There are mixed signals (as most of the times), but the chances of a recession starting during Q1 and Q2 of 2020 are still few. Let's see why.

Inflation is quite low (but increasing). It means that productivity is succeeding in offering new goods/services to an increasing demand from population.

This is healthy: a too high inflation means that people are consuming more than economy can supply, and this could lead to a crisis.

Note that inflation has recently gone from 1.77% (Oct-2019) to the actual 2.48% (Jan-2020). Not a scaring change yet, but getting higher could push the FED to hike rates.

Companies are doing quite fine. The manufacturing ISM is not brilliant, but has recently recovered somehow to 50.9%.

And companies can still find credit loans easily, which is good for investments (this data is mainly driven by FED's decisions about interest rates)

See how last recession (2008-2009) boosted the difficulty in getting money by companies, creating a vitious circle: recession-lack of credit-less investments-more recession.

The Yield curve is not in a good shape: it inverted in Fall 2019, and now it is rising up back again. This is typical to happen before recessions, BUT:

- it could take years before a recession arrives

- the curve has recently reverted down, so it is not increasing anymore

- everybody is looking at this curve and worring about (this also caused some of the drops of markets in Summer 2019) and the FED reacted promptly so far

The Housing market is doing very fine right now: it was the original sin that caused the 2008-2009 crash of markets. Now it is slowly and healthy recovering force and sustainability.

The Labour market is also doing very fine right now: unemployment rate is at its lowest levels.

More people working = more people consuming and respecting their debt obligations.

The concern here is that there is likely no space for further improvements. So, any deterioration of the employment could be a trigger for a drawdown.

The Unemmployment Rate has recently gone up from 3.5% to 3.6%. The change is very small, but it is very important it doesn't rise more, confirming a trend inversion.

Conclusions:

1. at a wide look, in January 2020 the US economy looks strong and no recession is likely in the short term

2. but the economy is not getting better either, looking like it is at its best and cannot improve further

3. if macro data get worse just a feew during next weeks / months, our Fundamental Indicator could turn to zero. It's been prositive since 2010, except short periods in 2016 and 2018.

About the Corona Virus

This insight is about Fundamantals data of US economy which show very low chances for an imminent recession.

But - generally speaking - markets can drop anytime if/when valuations of companies are getting too high compared to their "real" value (definition of "real" being an enigma).

After the long rally Sep19 - Feb20 a small drawdown (-3 / -5%) of indexes would be totally possible without affecting the general bullish outlook given by the macro data.

But macro data are very close to an inversion, and news about virus is adding something big:

- big cities are shutting down to contain the contagion,

- entire countries are limiting people mobility from and to other countries

- events are cancelled, shipments of goods delayed, and, most important

- nobody knows if this situation is getting better or worse during next weeks

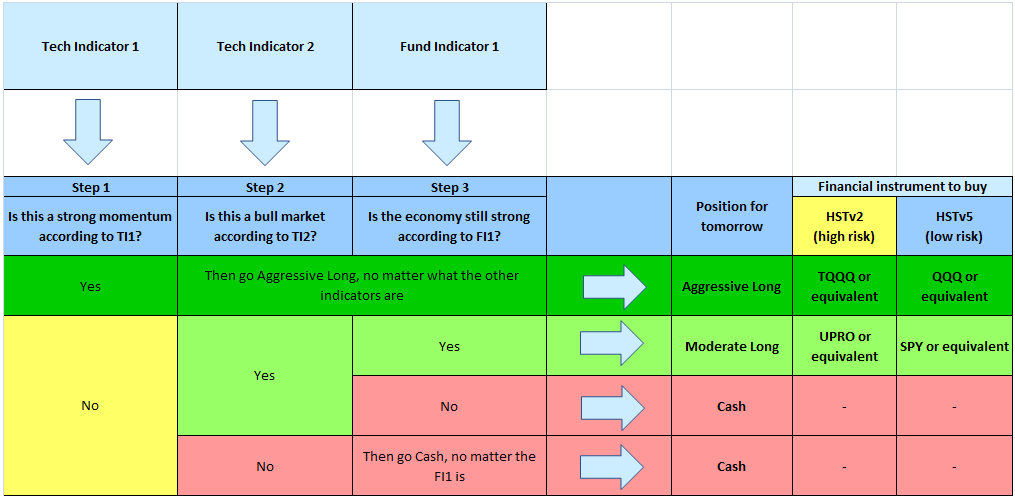

So here are the reasons for which I decided to hardly reduce my investing positions, despite the signal of the HST model:

- additional bad news about contagion could cause panic and further drop of indexes.

Tech Indicator 1 is not far to turn negative. Could be in a day or two. - consequences of the ongoing commercial limitations could affect the economy itself,

thus the Fundamental Indicator could shift to negative in a couple of weeks - the sum of the two above lines, could kick the HST model to CASH quite soon

But why am I anticipating this move? Why do not wait for the model confirmation?

Why follow my gut this time, since the model has proven to work better than my gut so many times?

It's because of risk-reward ratio.

After a semester with impressive gains on my investments, the chances for a "normal" drop are quite high already.

The variable of the virus brings these chances even higher, so I prefer to step aside for a while.

Obviously, if tomorrow good news about the contagion comes out, the markets will probably surge, and I will not benefit.

I am ok with it, and I will reopen my positions (following the model's signals as usual) when this variable is under control.

I thought it was important to tell the members about my decision.

Write to This email address is being protected from spambots. You need JavaScript enabled to view it. for more information.