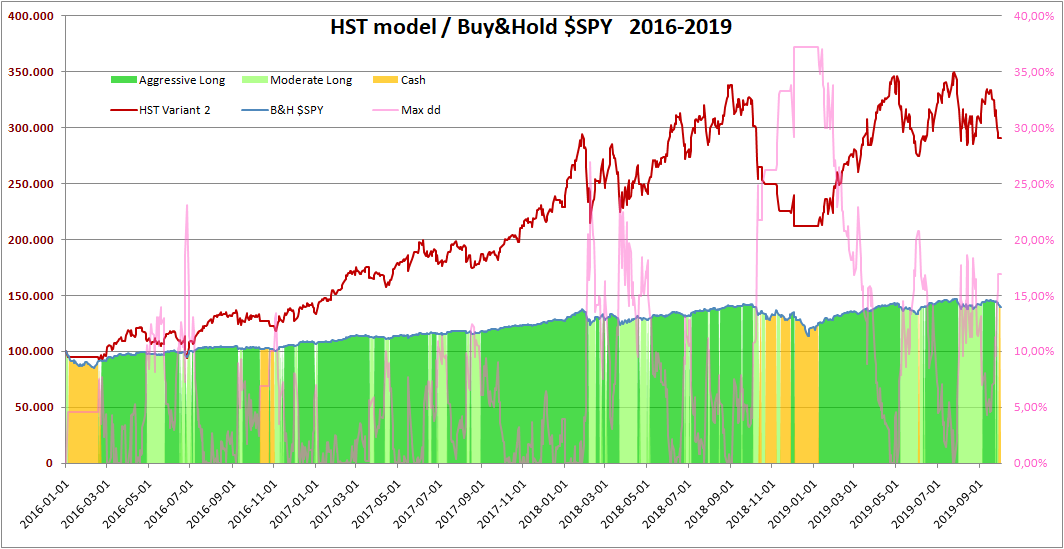

Last week was quite negative for stock markets, and the HST model shifted up and down between AL and ML. On Friday there was a bad drop, pushing the model down to Moderate Long.

But indexes recovered during last trading hour and futures for today are quite positive. In my opinion, this is beacause drops and rises are conditioned by news/tweets as never before, and this behaviour is covering the real trend of the indexes in the short term.

So I want to offer some more ideas to followers, concerning the next months and years for US stock markets.

Important premise: we will strictly apply the HST model, now and ever, anf the following ideas are not interfering with that.

Some more info about the model:

the HST model has 3 indicators,

- Indicators 1 and 2 are based on technicals (state of the US stock prices) - barometers 1 and 2 are related to these ones. Positive Indicator 1 means there is a strong momentum on the market, and pushes Aggressive Long, no matter what other indicators say

- Indicator 3 is based on fundamentals (state of the economy)

Bear markets or big corrections

When indicator 3 is negative (declining state of the economy ~ bear market), then the HST is usually CASH. Sometimes (only if indicator 1 is positive for strong momentum) the HST model returns to AL.

Going AL during bear markets happens only when the model catches some reversal trends and takes advantage of them for short periods.

Bull markets

When indicator 3 is positive (positive state of the economy ~ bull market), then the HST model shifts to AL when indicator 1 is positive, or to ML when indicator 1 is negative and indicator 2 is positive.

Being Moderate Long happens when - during bull markets - there are minor corrections, and the model does not suggest to go cash soon. It only pushes you to a less risky position (ML).

We've been living this condition for much time recently, but maybe it is changing now

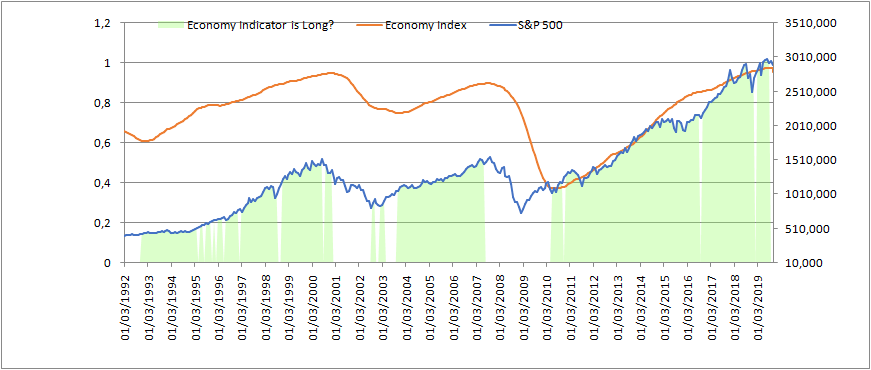

Where are we now, Sep 30th 2019?

It is a quite peculiar moment.

We are at the late stage of a very long bull market (2009-2019). Economy is still quite good, but some fundamental data is getting worse. We could see a bear market coming soon.

The point is that this could happen in 2019, in 2020 or even later. Nobody knows, and politics and Central Banks are making lots of efforts to avoid this time.

Still, our Indicator 3 could turn to bearish during next weeks/months. In this case we shall operate (according to the HST model) only shifting between AL (strong momentum) and CASH.

In my personal opinion (not according the model) I see at least a final rally up of the indexes as the most likely scenario. In this case the model will push us to AL.

If I am wrong, and the economy status will deteriorate quite soon, the model will push us into Cash as well.